Dial in the exact figure you need to own your future

Create a plan to get there on your own timeline

Build your own personalized, high-growth portfolio of stocks

I first created this “start to finish” system back in 2004 to help small groups of dedicated investors achieve their ultimate money goals.

It’s also the formula I personally followed to accumulate enough money to walk away from a high-paying corporate job and live the life I’d always dreamed of -- running a startup with the outrageous mission of getting 1 billion people investing successfully.

Beginner investors can use this program to create a targeted portfolio from scratch based on a crystal clear end goal…

Experienced investors can finally get the clarity they need on what companies should be in their portfolio, why, and how much they should be investing every month...

Even better, this program works if you’re 18 or 48… if you make $25,000 or $125,000 a year… or if you’ve made some serious investing blunders and need to make up for lost time.

Want to break free from the grind at 45 and spend your days traveling?

Great! OWN It 2021 gives you the tools to figure out how to make it happen.

Want to quit your job with enough money to launch the business of your dreams?

Fantastic! This will help you get there.

Even if you love your job and want to work until you’re 75, this program will help you build enough wealth to fund a worry-free retirement.

Best of all, it takes just 7 Days to get yourself on track, no matter where you are now.

The key is starting with a clear, intentional number you can stamp a date on and set up a system to achieve.

And because this system I’ve developed to do that is so templated, logical and easy-to-follow…

It’s a game-changer for beginner, intermediate and advanced investors alike.

Until now, it’s only been available to an inner circle of my friends and associates.

Among that group, engineers, lawyers, entrepreneurs, teachers, sales people and even musicians have come to me to learn how to execute this time-tested method of goal-driven wealth creation.

But, it wasn’t always this way…

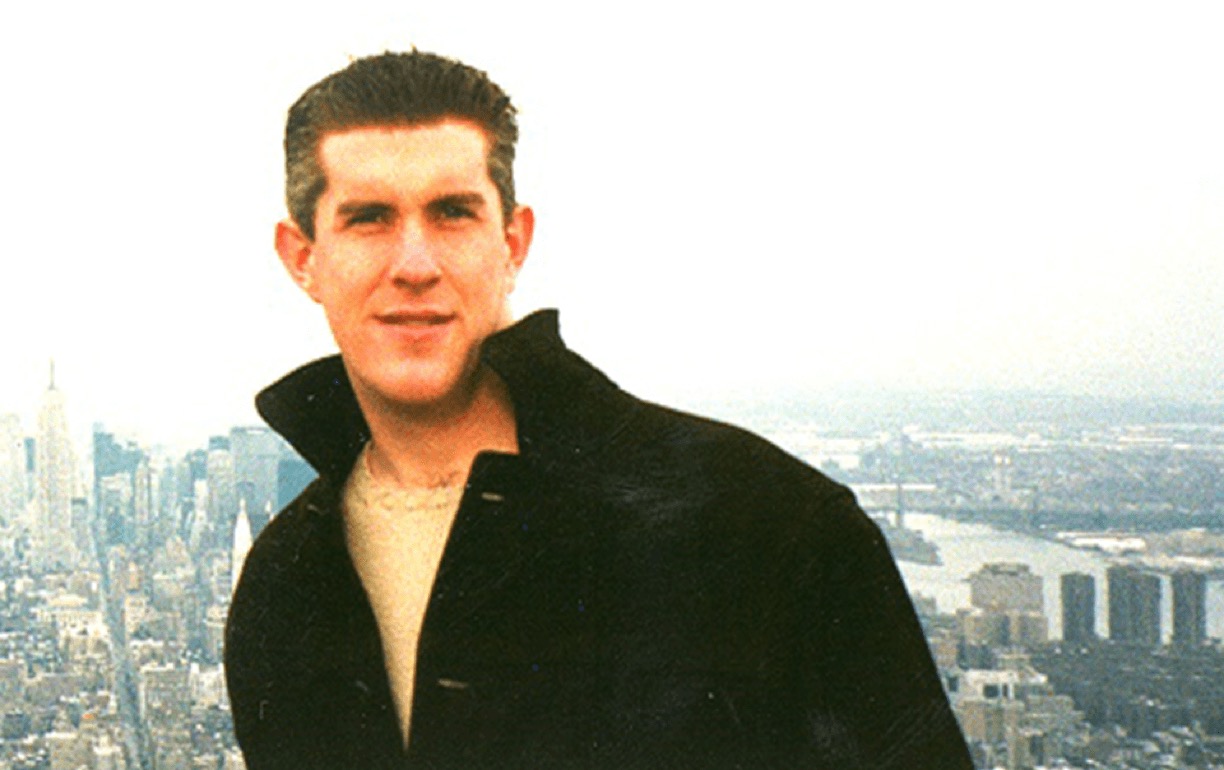

Before I created what would later become OWN It 2021, I was a well-intentioned investor with a passion for learning about companies…

Yet I lacked any sort of direction.

Look at that guy! So many big dreams that required MONEY to achieve. Yet I had no idea how much money or how to set up an investment plan to earn that money by the time I wanted to have it.

I was smart enough to model what I saw other successful investors doing at the time…

But I really didn’t have a “big picture” view of what my end goal was.

I never knew exactly how much I should be investing in any given week or month to achieve the wildly important goals floating around in my brain…

Or the market would start sliding and I’d panic and pull money out thinking I’d somehow figure out how to miss the bottom and jump back in when it was rising again..

I certainly didn’t know how many investments I should have in my portfolio…

Or how exactly I should spread them out over different size companies, industries and regions.

I didn’t know if a company had a competitive moat… or a competent management team… or bad debt…

And how was I supposed to find that out anyway?

Needless to say, I didn’t start out as an empowered, confident investor.

Maybe you’re just starting to build a portfolio and investing $500 is a very big deal…

Maybe you’ve been investing for years and you’re not sure if you’re really on track…

Maybe you have a huge dream that requires $$$, but you have no idea yet how to get there...

If any of that sounds uncomfortably familiar, then definitely keep reading.

Because the best part is coming up…

The part where I realized the three myths that were holding me back…

And the part where I took that realization and used it to create a targeted investing method that allowed me to build enough wealth in the stock market to finally own my life.

You know that feeling after an incredible massage?

Or the rush you get after hiking to a peak and then looking down at the glorious 360-degree view?

Imagine if you rolled those two feelings into one and then threw in a dash of pride… that’s what you’re going to feel after completing your 7-day journey through OWN It 2021.

Exhilaration, empowerment, relief, satisfaction and pride.

It’s not just knowing you’re able to attain your dreams, but knowing HOW you’ll do it.

You’ll be amazed by how much mental space suddenly frees up once you get clear on your OWN.

But remember, that’s just the first step…

You then dive headlong into creating your personalized plan for achieving your OWN by the target date you set.

After that, the forward momentum basically takes care of itself.

Before I tell you what these incredible 7 days are going to look like, let’s clear up the three myths I used to believe that may be holding you back right now…

My average annual returns over the course of twenty years beat the market 3 to 1! Anyone looking at my track record would be hard-pressed to call that a fluke. Not every stock picker will go on to beat the market, but I’m living proof that it can be your reality if you can follow a handful of simple rules.

The stock-picking methods I used to build the kind of wealth that allowed me to walk away from a corporate job and live my dream are the same ones I’ll show you how to execute for yourself. Investing in index funds has it’s place, but if you dream of the kind of outsized gains that will move you towards your OWN at an accelerated pace, the only way to achieve them is through buying and holding extraordinary companies for the long haul.

First of all, well done putting money into your 401(k) or the equivalent. I applaud you. But how do you know you’re investing the amount you need every month to get you off the hamster wheel of work before you keel over at your desk? And what kind of control do you have over the investments you own?

Even if you religiously sock away a portion of every paycheck, you still need to get clear on what amount of money will offer you financial freedom. Without that, you’re like a hiker without a map. Trust me, when the sun is setting and you’re starting to feel tired, you’re going to want to know what your destination is and how far you are from it.

Lest I take some of the shine off it, investing is much easier than you think. IF, of course, you are a long-term investor. Learning to find and screen companies to buy and hold for a decade or longer is completely doable as long as you understand the key elements you’re looking for.

Long-term investing is essentially a small handful of thoughtful decisions, structured in a deliberate order. The key is to be selective about what you buy, rarely sell and learn to identify companies that are going to be in an even stronger position in ten to twenty years. Historically, that’s the recipe for how millionaires are made. Lucky for you, it’s one of the easiest recipes to follow.

You’re about to learn how to create a framework for financial freedom through investing in the stock market.

No more wondering if you’re not doing enough or if you’re sacrificing too much in order to achieve your dreams on the timeline you want to…

No more aimlessly buying into this or that stock without understanding whether or not it’s a great long-term investment…

No more doing what everyone else is doing and getting average results

Not anymore. OWN It 2021 is your launchpad for smart, empowered, goal-driven investing.

Financial freedom doesn’t happen by accident. It happens by design.

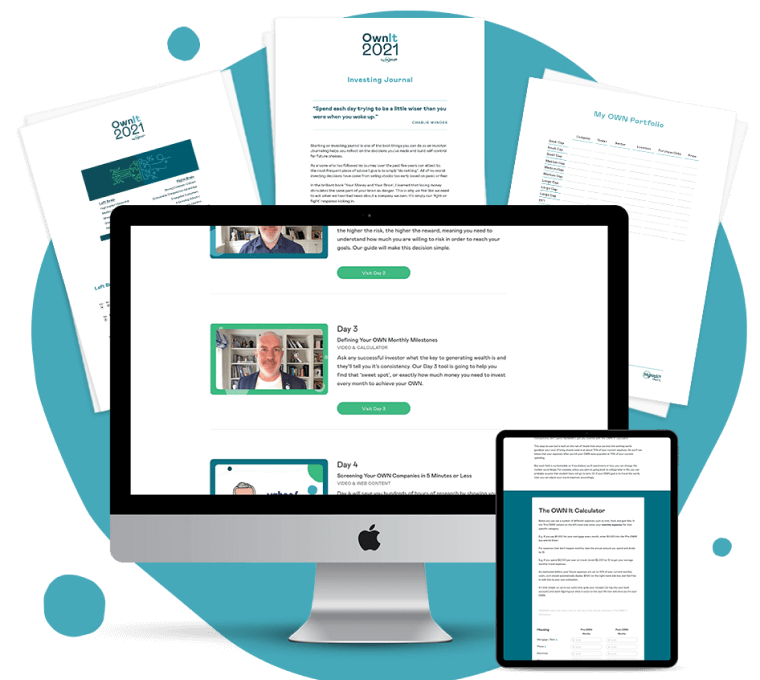

Day one is all about drilling down to the nuts and bolts of discovering your “Opportunity Waits Number” or OWN.

We’ve created a custom calculator that walks you piece by piece through how much you spend to maintain your current lifestyle. Then, we automatically adjust those numbers for life after your daily grind.

By using formulas you can customize based on your own timeline and by making sure we’ve left no stone unturned, you’ll arrive at your OWN with full confidence that you now have a personal target that works for you.

Finally getting a grasp on this number will lay the foundation for everything that comes next. It’s the clarity you’ve been searching for and the launchpad for all the fun about to come…

Once you see your OWN shining like a beacon on the horizon of your life, it’s time to get acquainted with the investments that will help you get you there…

Anyone can say, “I want to own high-growth stocks so I can earn as much money as possible quickly.” But the reality is that big rewards can also bring high risks.

Most investors don’t take more than a few minutes to think about what their appetite for risk is. It’s just a quick radio button you click on an application when opening a brokerage account. But if you skim over it, investing can turn out to be a painful experience.

That’s why Day 2 will help you truly understand what your tolerance for risk is by taking a look at how you deal with loss and volatility, what your reactions tend to be in those situations and the length of time until you aim to hit your OWN.

Without a personal understanding of your risk tolerance, you don’t have a compass to help you narrow down the universe of stocks. (Remember, there are over 2,800 stocks on the U.S. exchanges! You need as much help as you can get narrowing down the ones that are right for you on your OWN journey.)

Only once you truly understand your personal risk tolerance can you project the annual returns you can expect on your investments. It’s a critical puzzle piece you need to have in place before moving on to Day 3.

Now that you’ve got your OWN and you understand your personal tolerance for risk, it’s time to drill down to how much you’ll need to invest on a regular basis to achieve your ultimate goal.

Day 3 includes an easy-to-use tool that allows you to adjust all the variables of your investing plan until you identify your personal “sweet spot”… that is, the place where you’re on target for achieving your OWN on a timeline that works for you and with a regular investment amount that fits your budget.

Even if you did nothing else beyond this day (but that would be crazy!), you could take this number, “set and forget” into any brokerage account and still be 95% ahead of most people.

A few months back, I got the whim share my personal stock screening process on a call with a few members of the Horizon community. The feedback was overwhelmingly positive.

One of the attendees said “Getting a firsthand view of your approach to research was absolutely fantastic. I tried the tools you shared immediately afterwards and have been using them daily ever since.”

So I’ll cover the exact same process here on Day 4. Namely, how you can copy and paste the 4-step process I use to vet all my stocks using free tools available on the internet in under 5 minutes.

This “red light /green light” tool probably saves me hundreds of hours every year researching stocks.

By adding this to your arsenal of tools, you’ll be able to quickly and easily determine whether or not a company is worth investigating further before it earns a coveted spot in your OWN portfolio.

I’ll take you over my shoulder and show you my screen as I walk through exactly what I look for, where to find it and how to interpret what you see.

You will not find this inside look anywhere else in any of our products. This is a brand new recording that I’ve never shared publicly before.

Once a company gets the “green light” using the pre-screening tools I showed you on Day 4, it’s time to sit down and thoroughly vet its potential.

Remember, these are stocks you will hold for a decade or longer! It’s important to put in just a short amount of deeply-focused research at the get-go in order to save yourself years of heartache later on.

But don’t worry, this deeper level of research doesn’t have to be intimidating, especially once you get your hands on my favorite research tool, The New and Improved Extraordinary Stock Checklist.

This checklist is the “secret sauce” behind every ten-bagger (a stock that’s returned over 900%) I’ve ever owned in my portfolio. And I’ve had at least 20 so far.

This has always been my #1 most requested resource and now I’ve improved it to make even more easy-to-use, even if you don’t have a clue how to begin researching stocks online.

Even professional Wall Street analysts make the same mistakes and underperform because they don’t consider many of the simple yet highly intuitive questions you’ll get access to on this one-of-a-kind checklist.

You can either hang a hard copy by your computer, keep a stack of them on your desk to mark up as you research, or simply use the interactive tick boxes on the digital copy I’ll send to you.

This single resource will level up your investing game from the first time you use it, giving you a headstart over other investors who just wing it or invest on a hunch.

So if you’ve ever felt lost when it comes to how to properly research a stock, Day 5 of OWN It 2021 will be a gamechanger for you going forward.

Beating the market requires as much right brain activity as it does left-brain thinking.

While analytical research points me in the right direction, logging my investing decisions into a journal is where I develop the intuition and insight that makes all the difference in the long run.

My investing journal sits next to me every day and is filled with scribbles, ideas, notes, questions and revelations. I don’t know what I’d do without it.

If I ever handed it to someone, I think they could write my biography based on the stocks I fall in love with and those I eventually reject.

So, on Day 6, I’m giving you your own investing journal. I’ve taken the way I tend to use mine and I’ve templated it for you so you can hit the ground running as you begin building your OWN portfolio.

I’ll walk you through the best way to use it, the key decision questions and the decision logs you’ll find inside.

Your OWN investing journal will come as an interactive document and you’ll be able to print it out, type in the digital version or adopt the template in a notebook of your choice.

The final day ties everything together and sets you on a 12-month journey to build the portfolio that will put you square on the path to your OWN.

Day 7 goes deep into designing your portfolio with an emphasis on proper diversification.

If that sounds complicated, don’t fear!

Day 7 includes an interactive guide and worksheet that will:

Diversification is something too many investors gloss over, but when the markets get shaky, it can be the only thing protecting you from losing money you might never get back.

This guide helps you build a portfolio that’s nearly bulletproof by giving you an easy-to-follow blueprint you simply can’t screw up.

So in case that end goal isn’t enough to get you over the hump and into OWN It 2021, consider all the extra benefits you’ll get from this program:

You can use the custom calculators to create secondary investing plans for big goals like a car, home, a child’s college expenses…

You will get access to my personal research templates and methods that will help you better analyze the merits of any business going forward, whether someone else’s or your own…

You can involve your spouse, your kids, even your roommate in OWN It 2021 right along with you, inspiring them to take full ownership of their financial future too…

I’m asking you to take a chance on OWN It 2021 today, because I want you to step forward and take full ownership of your extraordinary future.

In exchange, I promise that if you put everything I show you to use over the next 12 months, you will be closer to financial freedom than you ever thought possible.

So I’m offering my OWN personal guarantee today:

If you follow each step I outline and put it into practice, including building your OWN portfolio over the next 12 months and you still don’t feel like you’re on track to achieving your OWN by the date you’ve set for yourself, simply email my customer service team at hello@mywallst.com, let us know your situation and we’ll refund your money.

If you do the work, I know you’ll get the results you’re after. I know because this is what has worked for me for over two decades and catapulted me far beyond my original “Opportunity Waits Number.”

The program is spread out over 7 different modules. I suggest setting aside 30 minutes on average for each one. Day 1 may take longer, however, because it is quite in-depth.

You will have access to all course modules the moment you sign up, so you can move through them as quickly or slowly as you like.

Sure, you might be able to. But you certainly won’t do it in seven days! And aren’t you kind of sick and tired of putting off something this important?

If you see a future for yourself where you call the shots every day, then figuring out how you’re going to get there should be your priority. And right now, the map with a big red X just fell in your lap. Grab it.

YES! 100% yes. If someone had offered me this kind of blueprint to follow before I began investing, I would probably have had a statue of them built in the town square. That’s how grateful I would have been to have gotten such a headstart before I made the huge mistakes I could have avoided when I was a young investor.

Most free retirement calculators are designed as lead magnets for financial institutions who would like to sell you brokerage services. They tend to be quite basic and skip over a lot of pertinent information. Often the number you end up with using a free calculator is inaccurate.

OWN It 2021 is designed to not only give you a realistic target number you can feel confident in, but also walks you through how to achieve it through smarter investing.

But all I can do right now is tell you from experience that having an “Opportunity Waits Number” to target is the only way to pull yourself out of uncertainty and into a future that is 100% yours.

If you are even the least bit unsure of what you are working towards and how being a skilled investor is a critical part of achieving that, then what are you waiting for?

You’re one step away from accessing the exact steps that took me from the life I was supposed to live and deposited me squarely into the life I wanted to live.

Plus, your investment today is backed by my personal "do the work, get the results" money-back guarantee.

So whether you’re 18 or 48… whether you’re a seasoned investor or a total newbie… there’s so much waiting for you inside OWN It 2021.

It’s time to get to it.

© 2024 MyWallSt Ltd. All rights reserved. This website is operated by MyWallSt Ltd (“MyWallSt”). MyWallSt is a publisher and a technology platform, not a registered broker-dealer or registered investment adviser, and does not provide investment advice. Brokerage services are provided to clients of MyWallSt by DriveWealth LLC, an SEC registered broker-dealer and member FINRA/SIPC. Investing involves risk and investments may lose value. Past performance does not guarantee future results. “MyWallSt“, “Own It“, “Brilliant Investing Made Easy” and “Tap To Invest” are registered trademarks of MyWallSt. Privacy Policy.